Monitor portfolio data from the source—across every asset class

Unify your front-to-back office workflows — from diligence to monitoring to actionable reporting.

Unify your front-to-back office workflows — from diligence to monitoring to actionable reporting.

Unify your front-to-back office workflows — from diligence to monitoring to actionable reporting.

Talk with us

Talk with us

Trusted by asset managers to wrangle data for 3,000+ companies

Trusted by asset managers to wrangle data for 3,000+ companies

Institutional-scale portfolio management, built for credit and equity

Institutional-scale portfolio management, built for credit and equity

Institutional-scale portfolio management, built for credit and equity

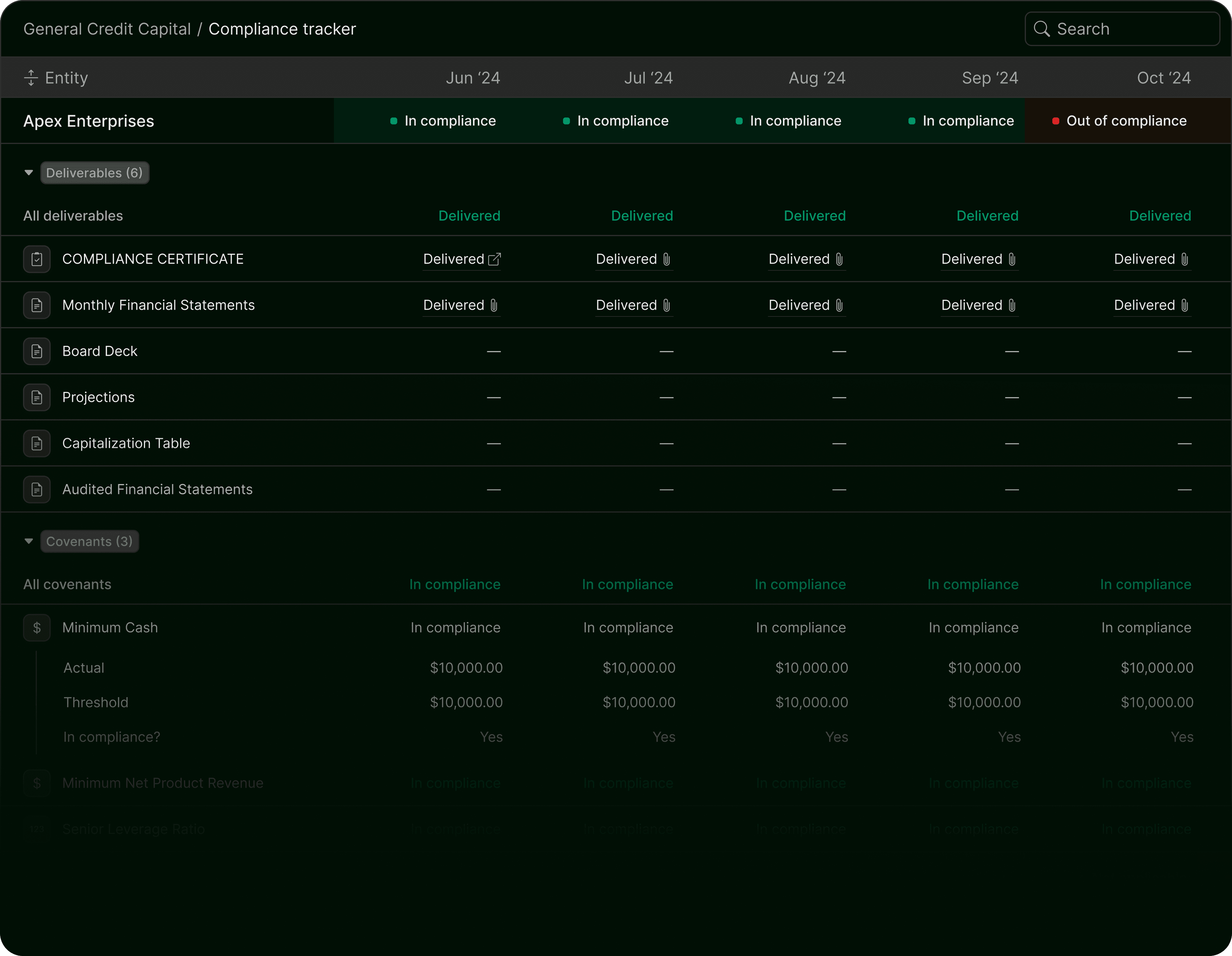

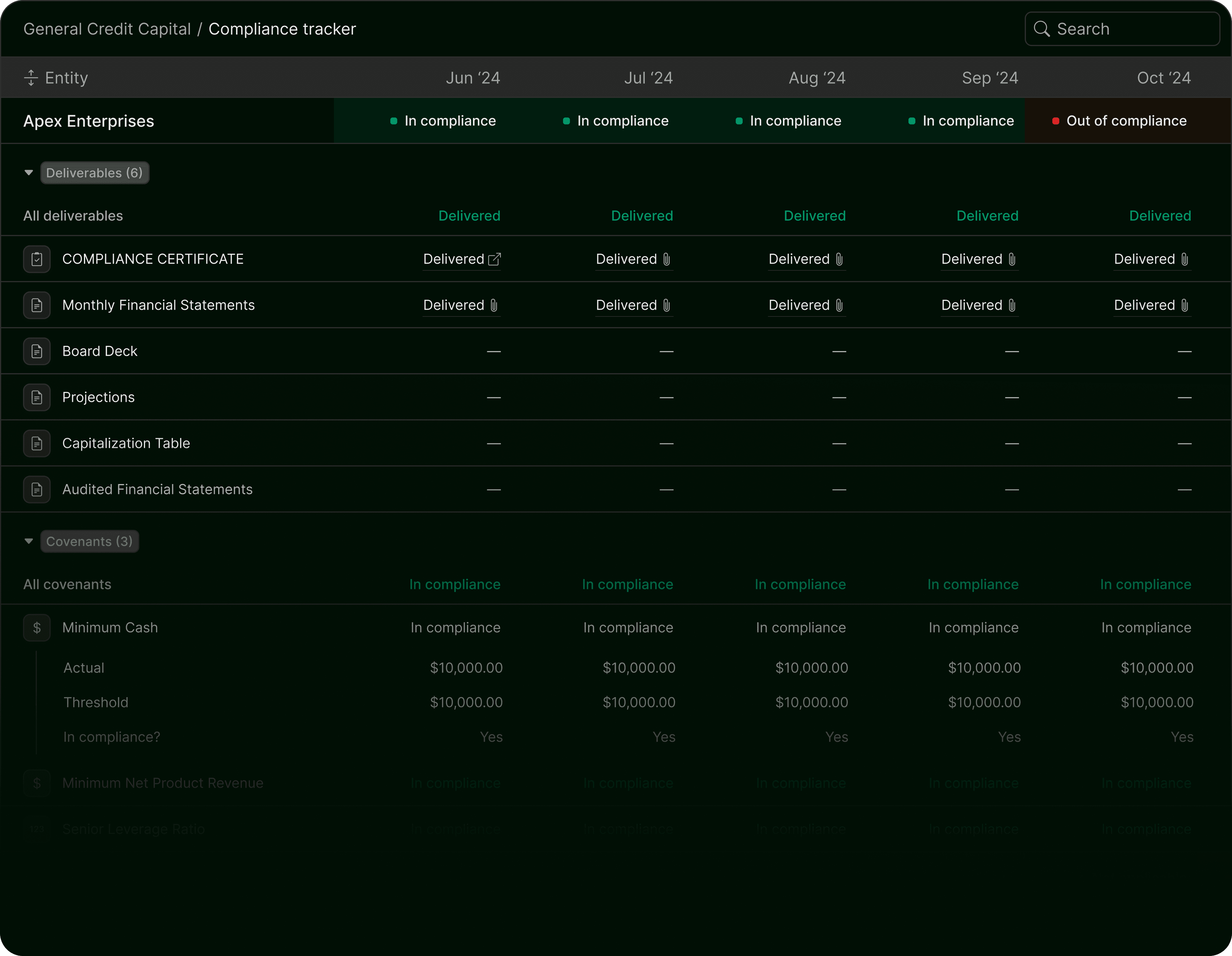

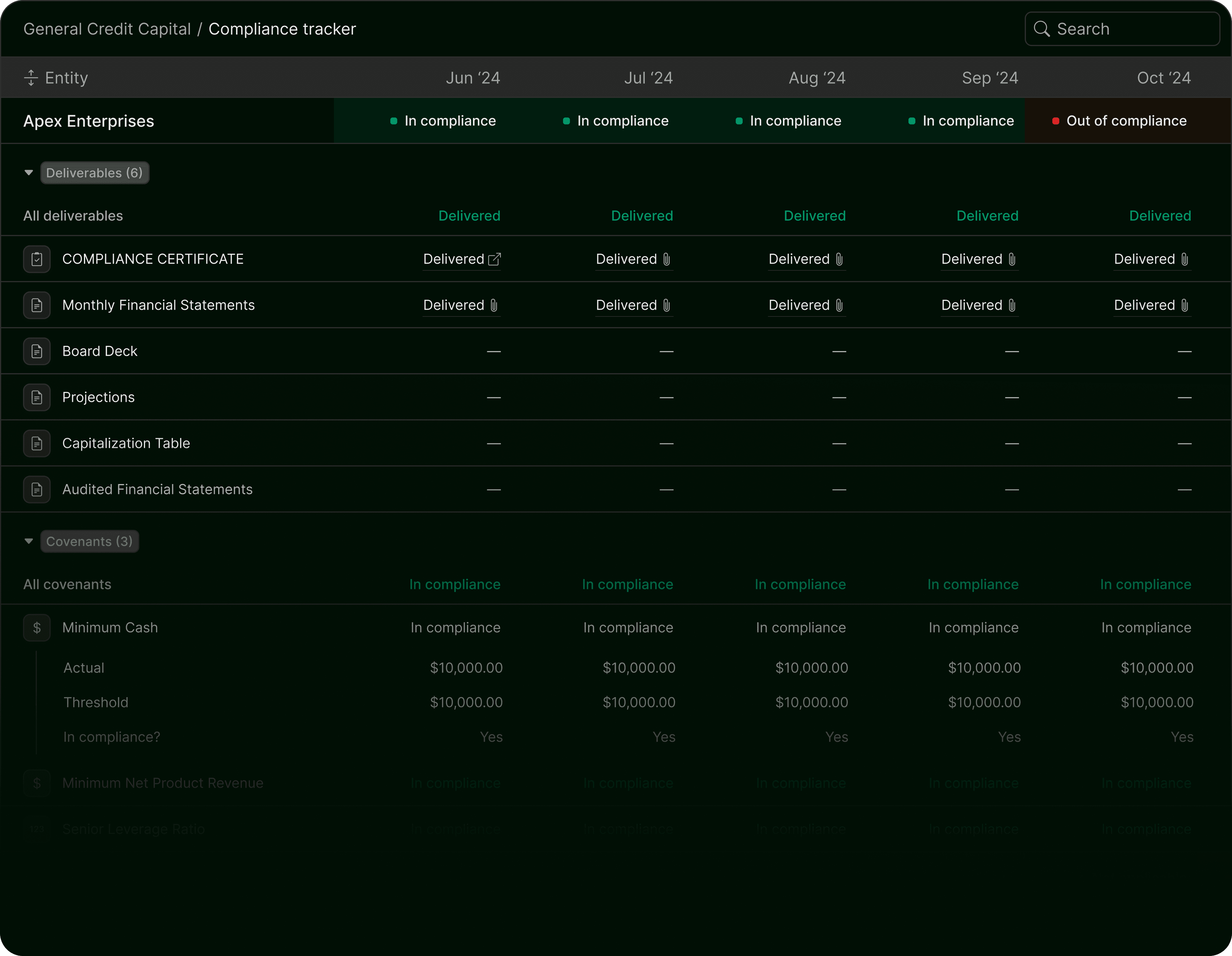

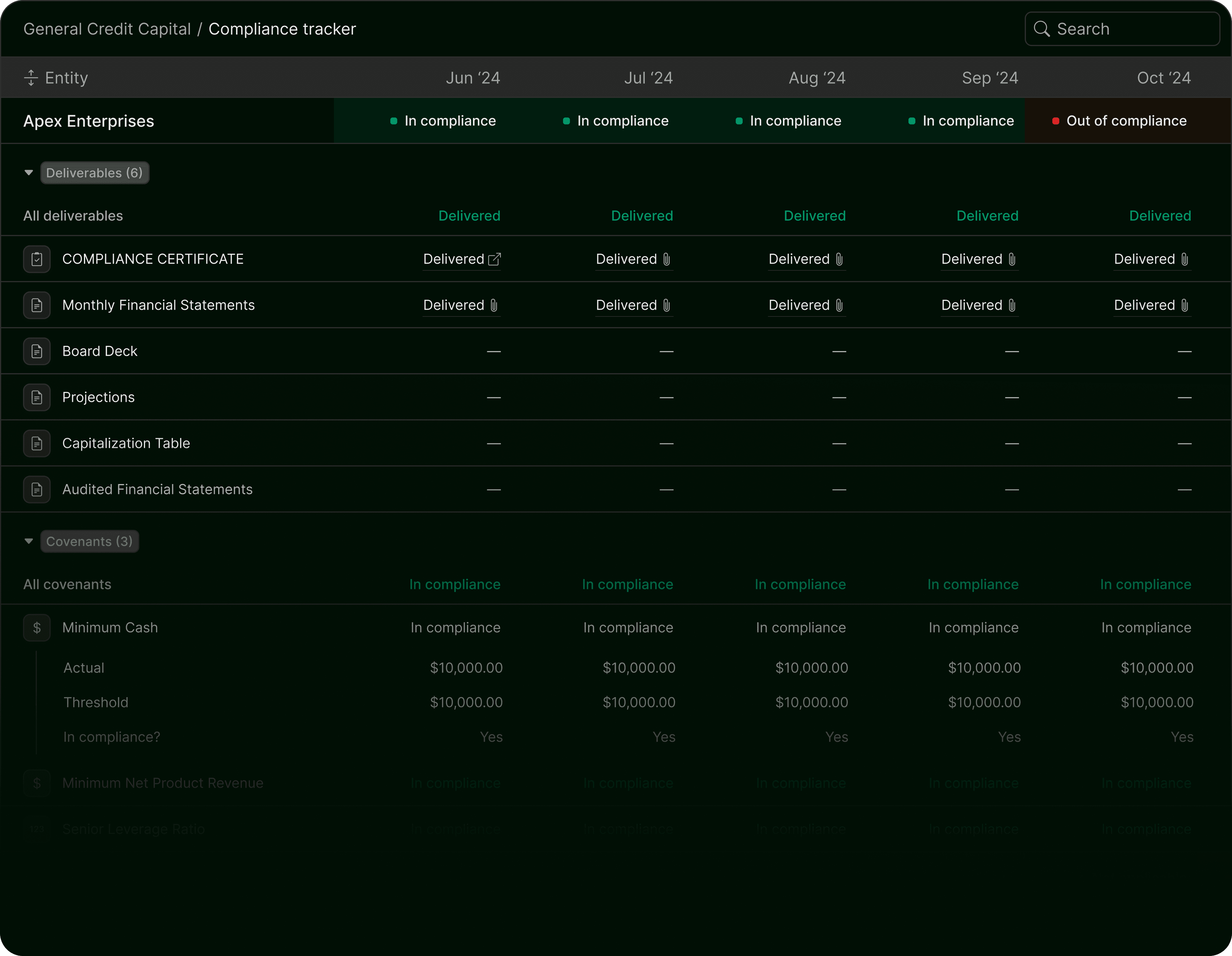

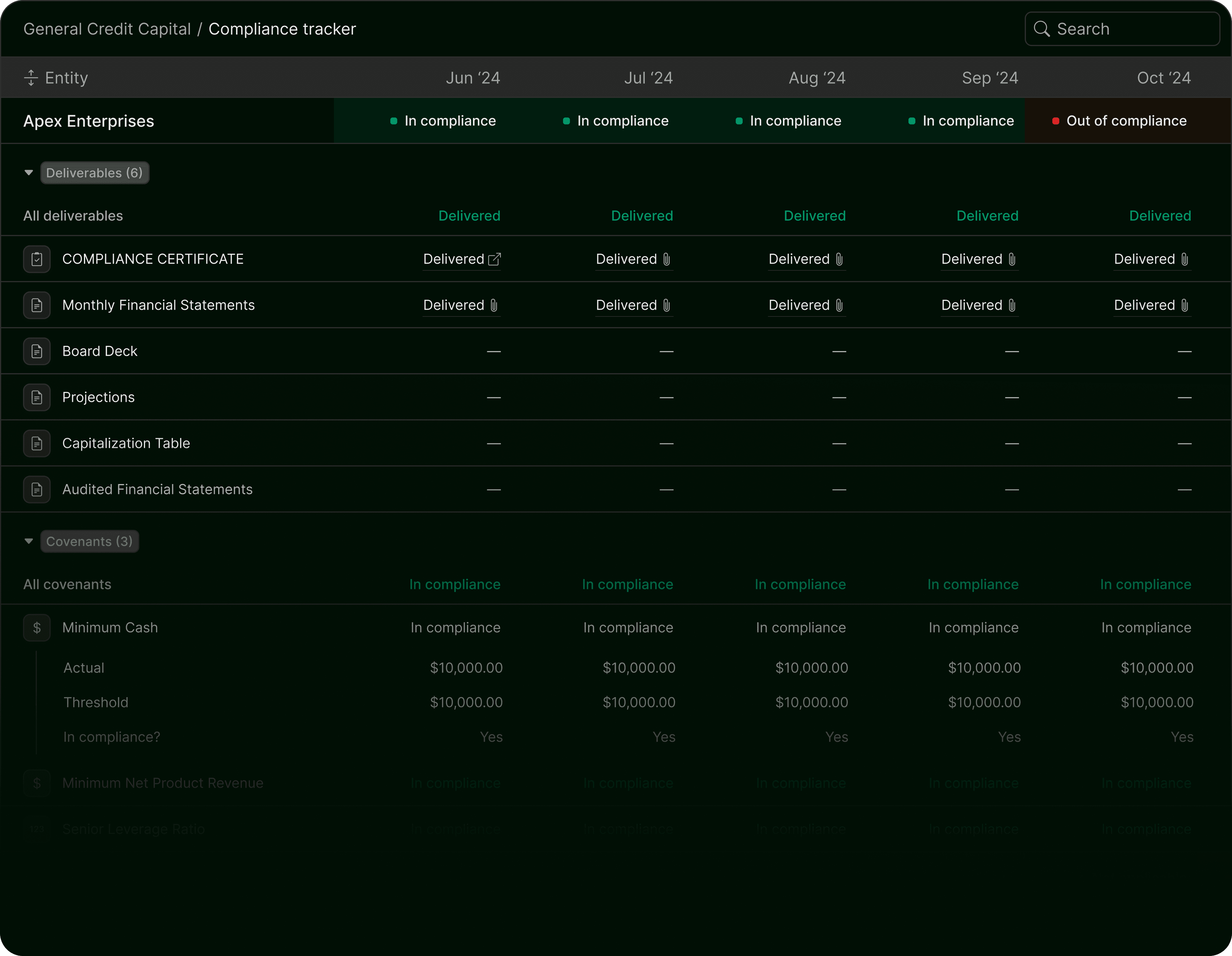

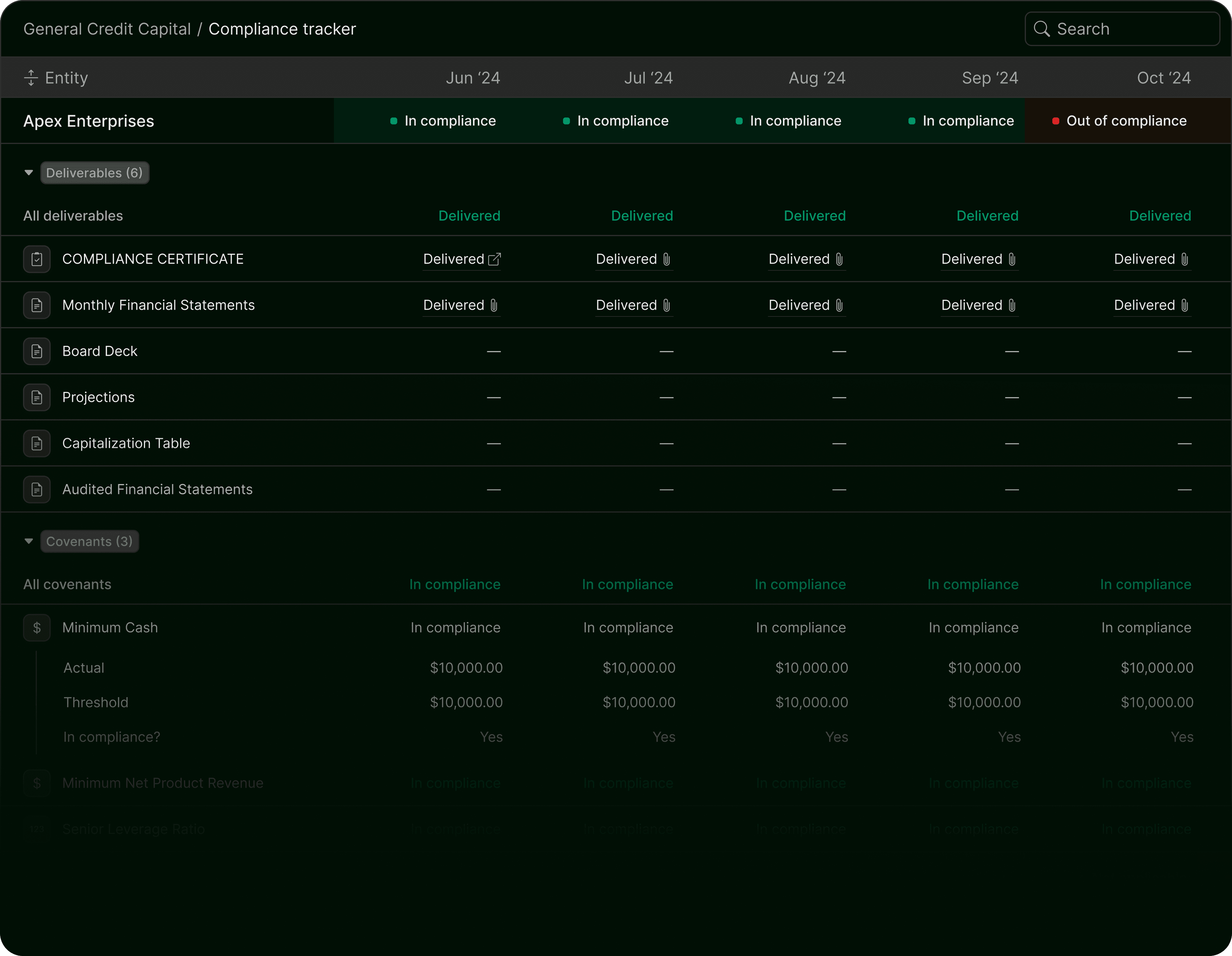

Focus your team on investing, not data collection

Stop wrangling spreadsheets and chasing portfolio companies for data. Delegate data collection, ingestion, and portfolio review templates to us.

Focus your team on investing, not data collection

Stop wrangling spreadsheets and chasing portfolio companies for data. Delegate data collection, ingestion, and portfolio review templates to us.

Focus your team on investing, not data collection

Stop wrangling spreadsheets and chasing portfolio companies for data. Delegate data collection, ingestion, and portfolio review templates to us.

Meet Lu, your AI-powered data wrangler

Access your data using natural language—empower anyone at your firm to ask questions and get instant answers. Accurate, real-time trends and easy drill-downs with complete data privacy.

Meet Lu, your AI-powered data wrangler

Access your data using natural language—empower anyone at your firm to ask questions and get instant answers. Accurate, real-time trends and easy drill-downs with complete data privacy.

Meet Lu, your AI-powered data wrangler

Access your data using natural language—empower anyone at your firm to ask questions and get instant answers. Accurate, real-time trends and easy drill-downs with complete data privacy.

Turn unstructured data into deal decisions

Unlock data trapped in spreadsheets—from underwriting models to monitoring reports. Build the proprietary benchmarking dataset you’ve always wanted and apply it to assess new and follow-on investments.

Turn unstructured data into deal decisions

Unlock data trapped in spreadsheets—from underwriting models to monitoring reports. Build the proprietary benchmarking dataset you’ve always wanted and apply it to assess new and follow-on investments.

Turn unstructured data into deal decisions

Unlock data trapped in spreadsheets—from underwriting models to monitoring reports. Build the proprietary benchmarking dataset you’ve always wanted and apply it to assess new and follow-on investments.

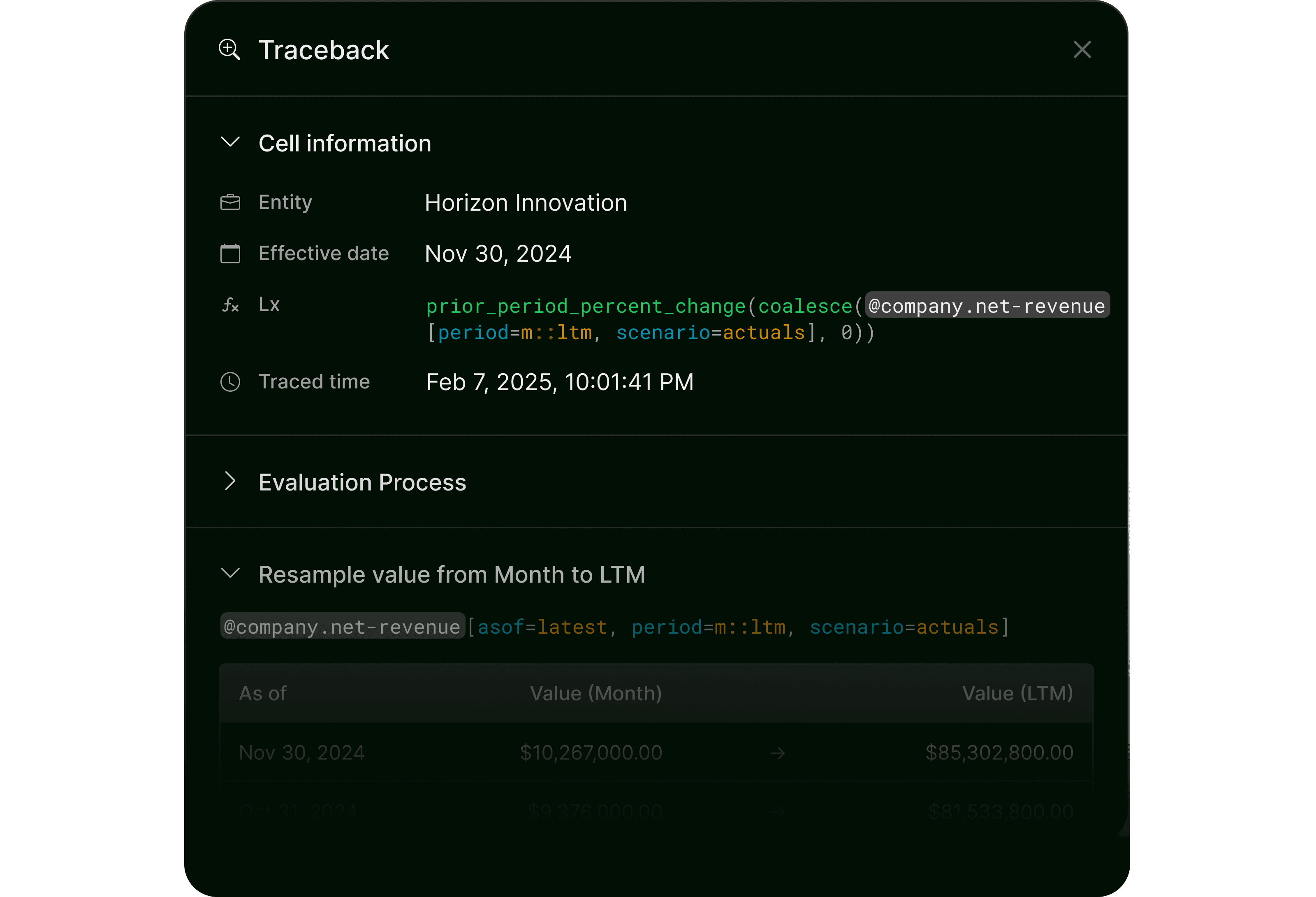

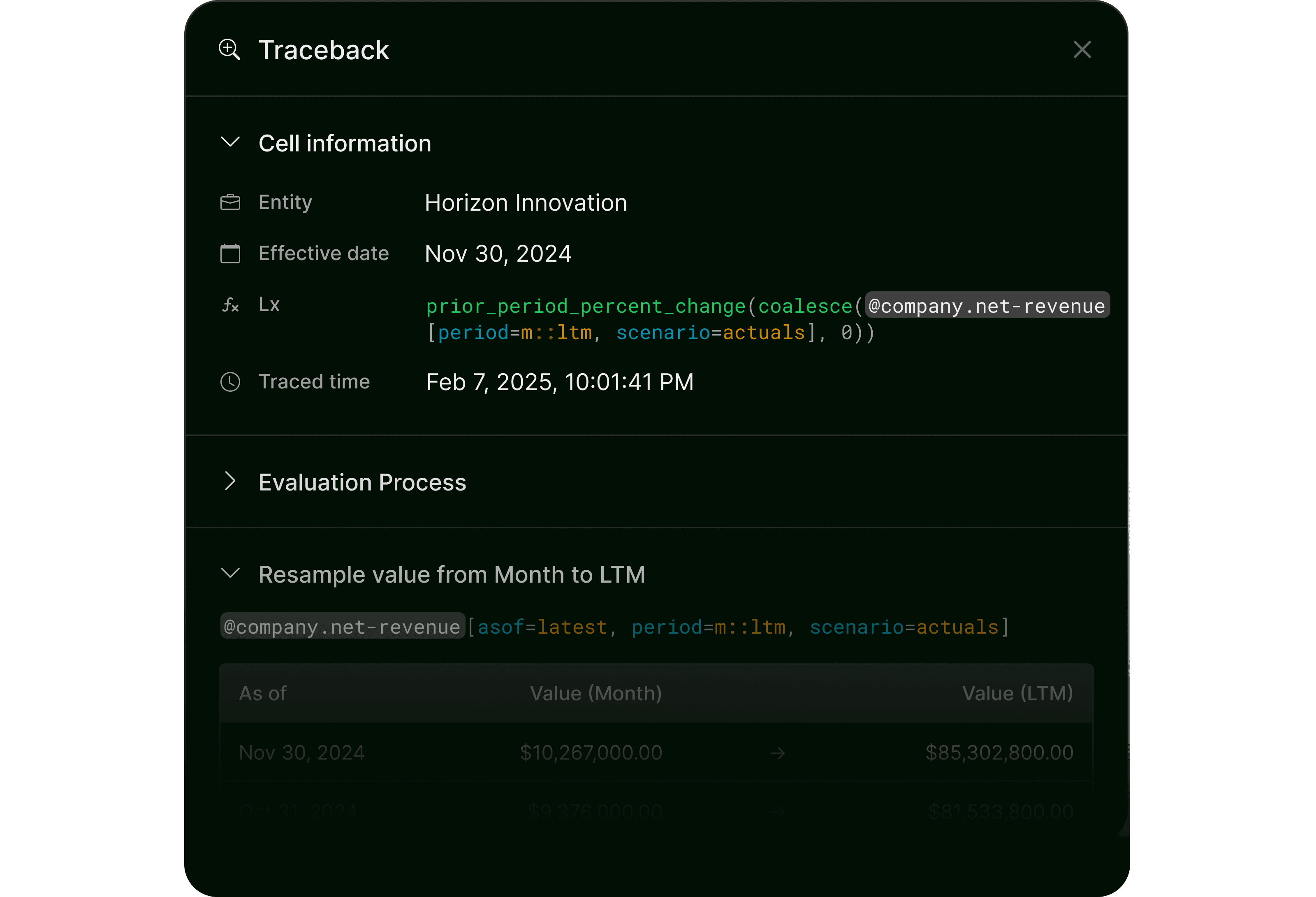

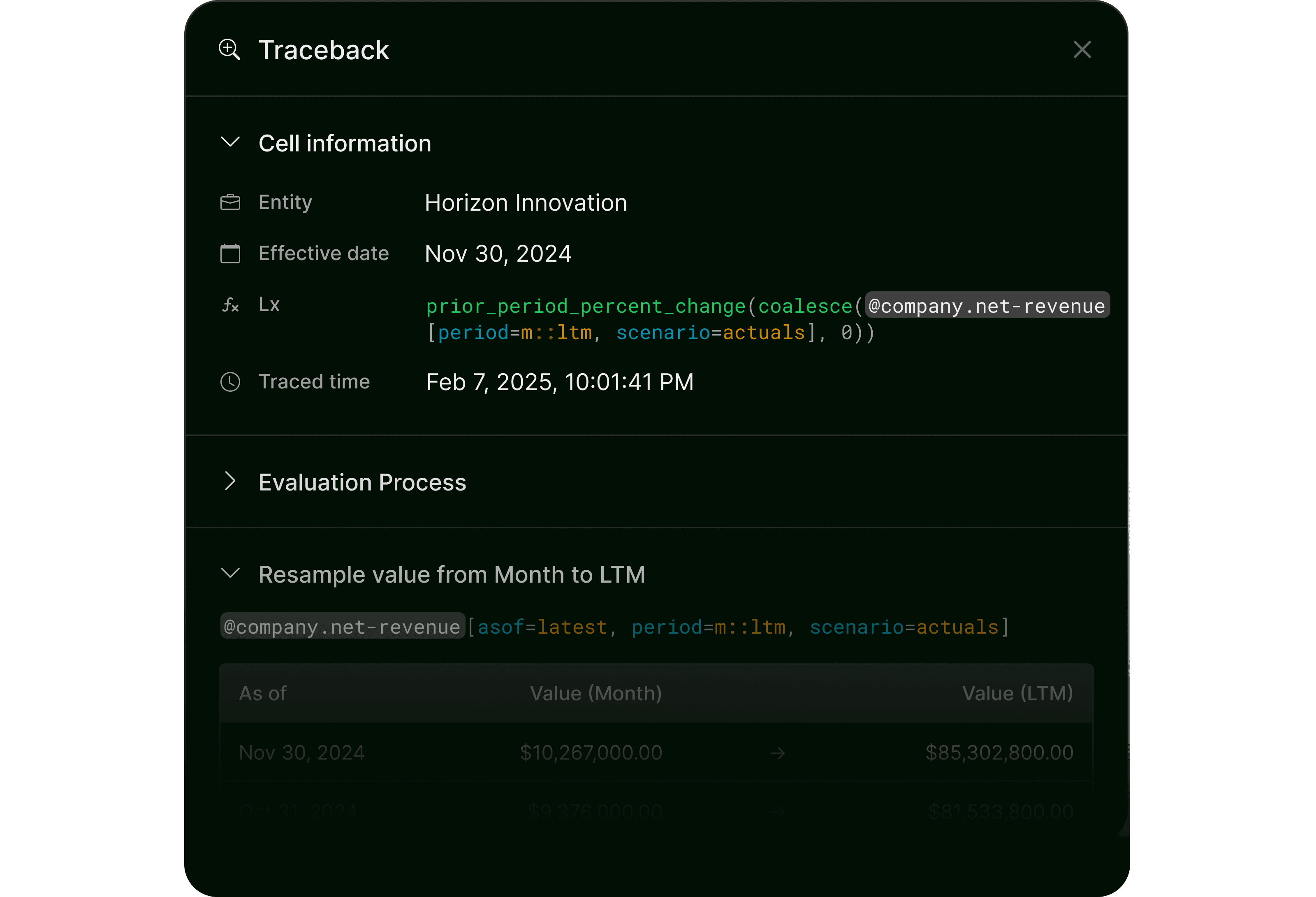

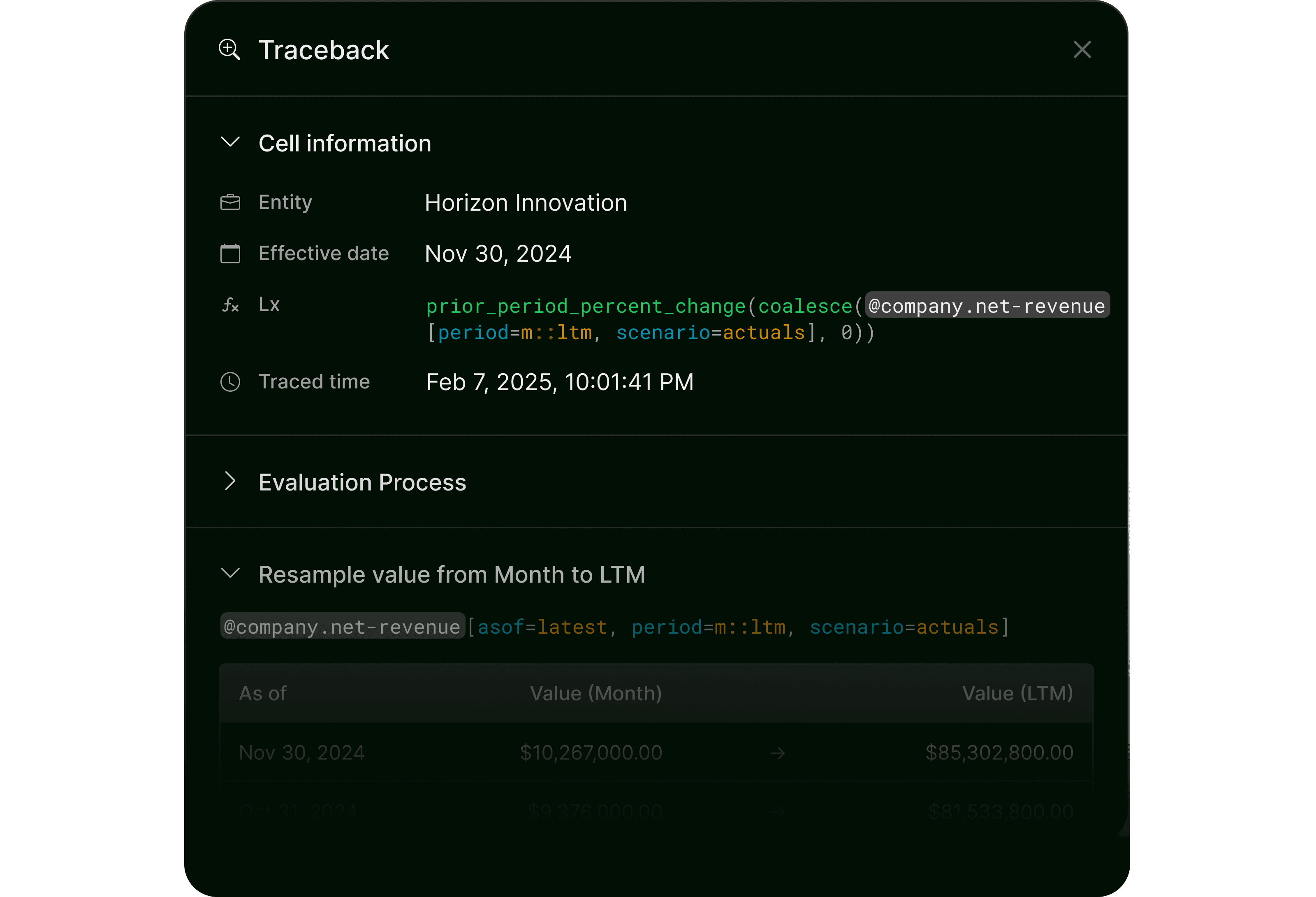

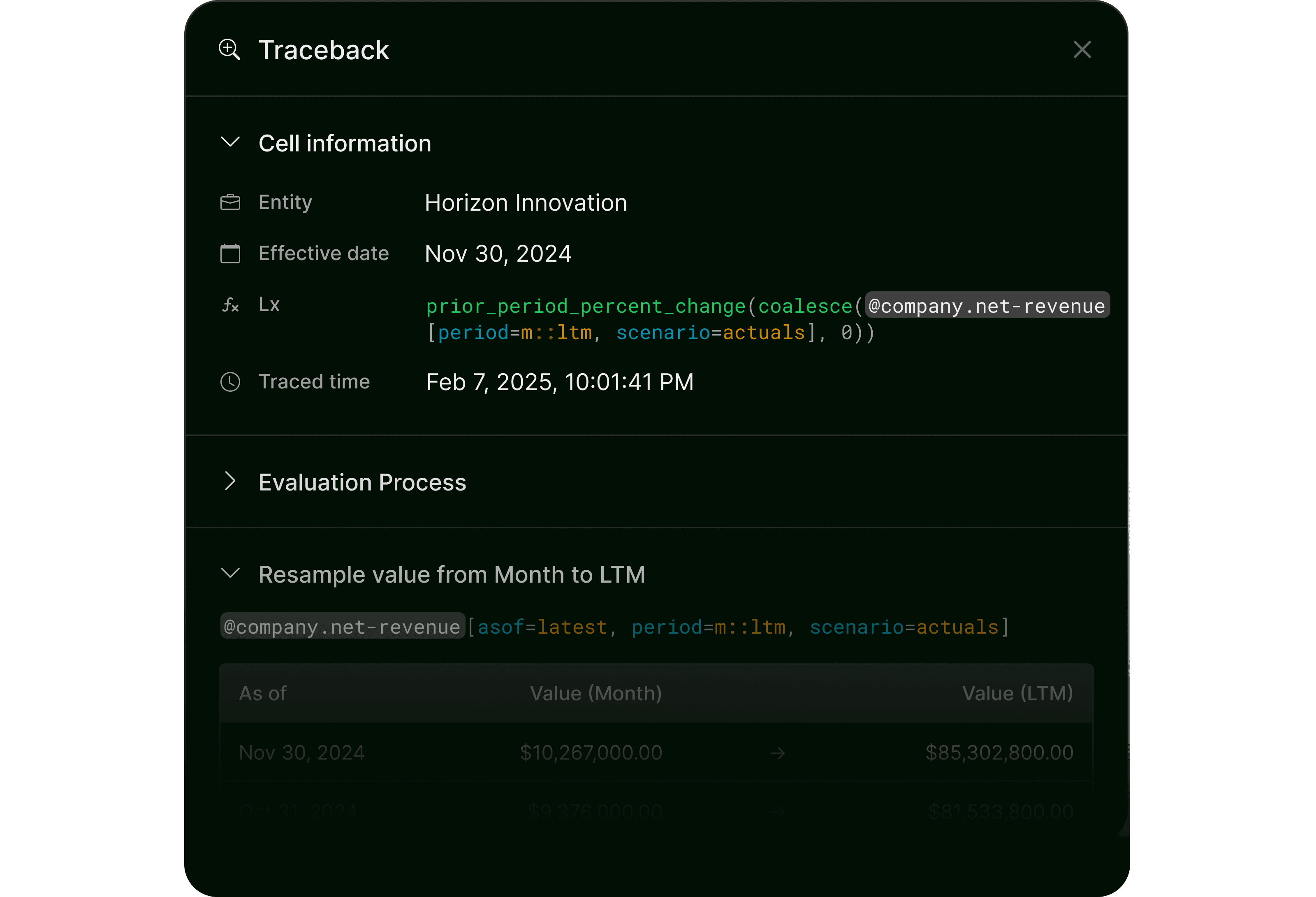

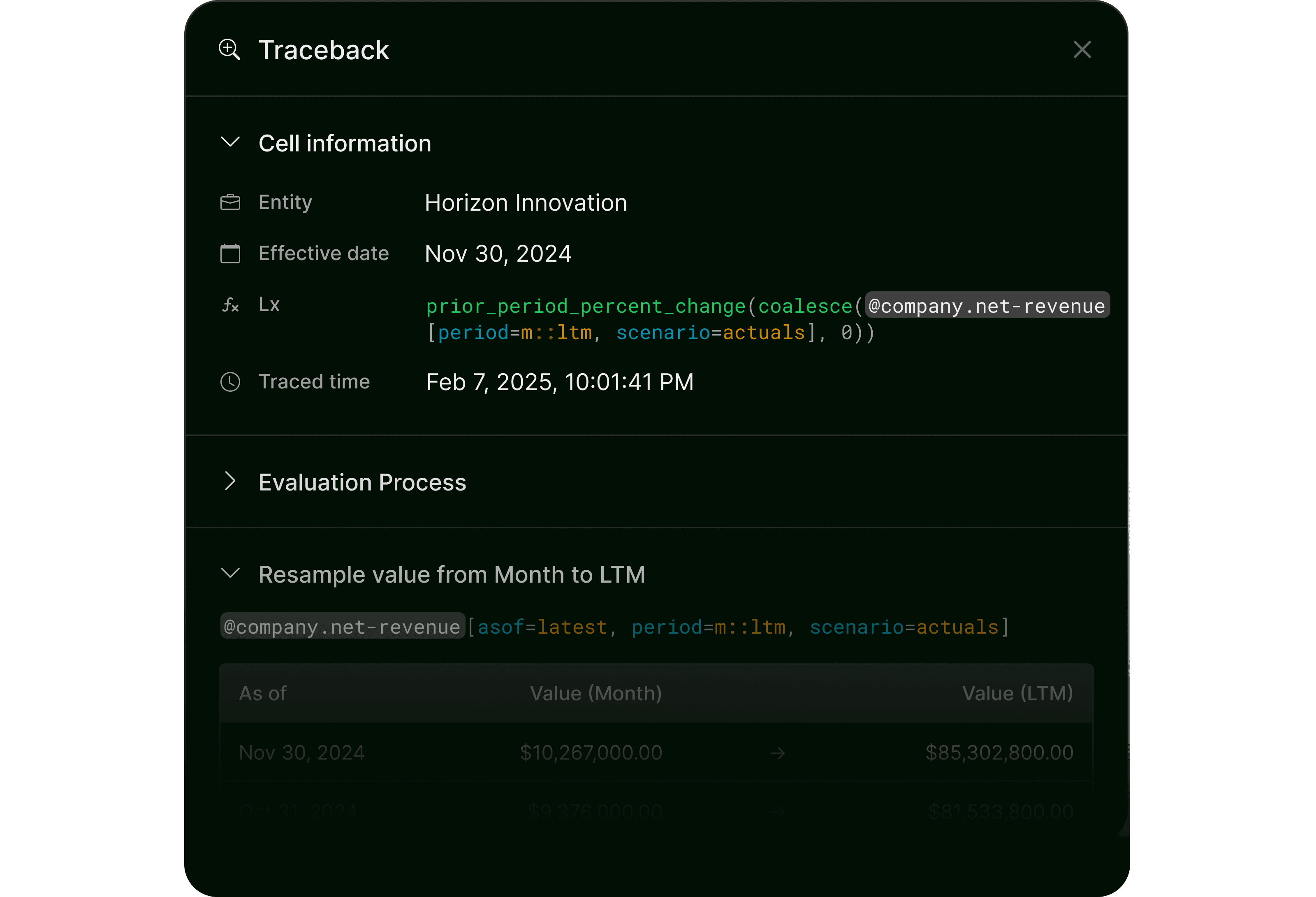

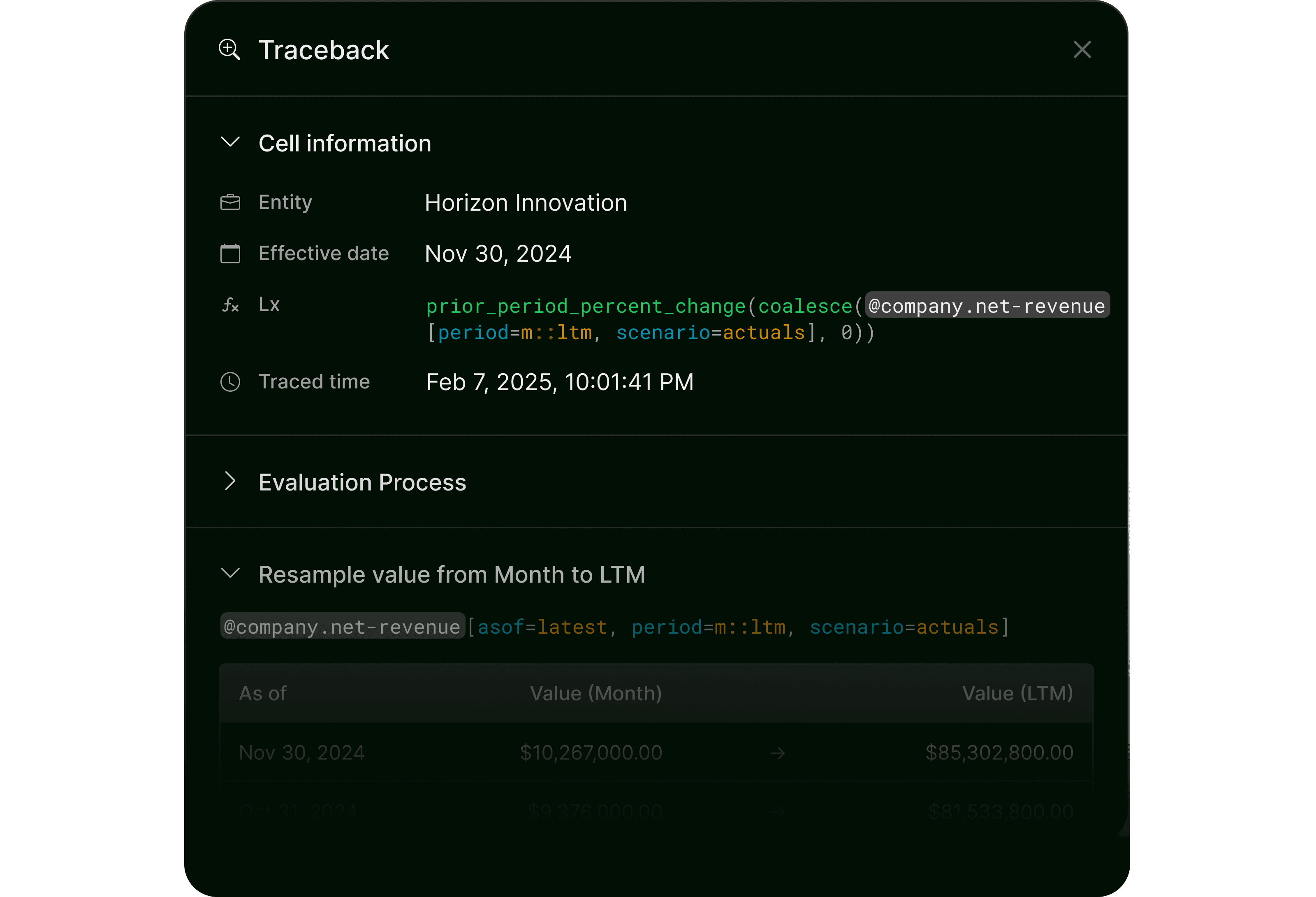

Trust but audit your data

Harness the power of public market standards by accessing source data with full traceability to original files and underlying calculations. Always be one click away from source data—and monitor changes in actuals, budgets, and forecasts.

Trust but audit your data

Harness the power of public market standards by accessing source data with full traceability to original files and underlying calculations. Always be one click away from source data—and monitor changes in actuals, budgets, and forecasts.

Trust but audit your data

Harness the power of public market standards by accessing source data with full traceability to original files and underlying calculations. Always be one click away from source data—and monitor changes in actuals, budgets, and forecasts.

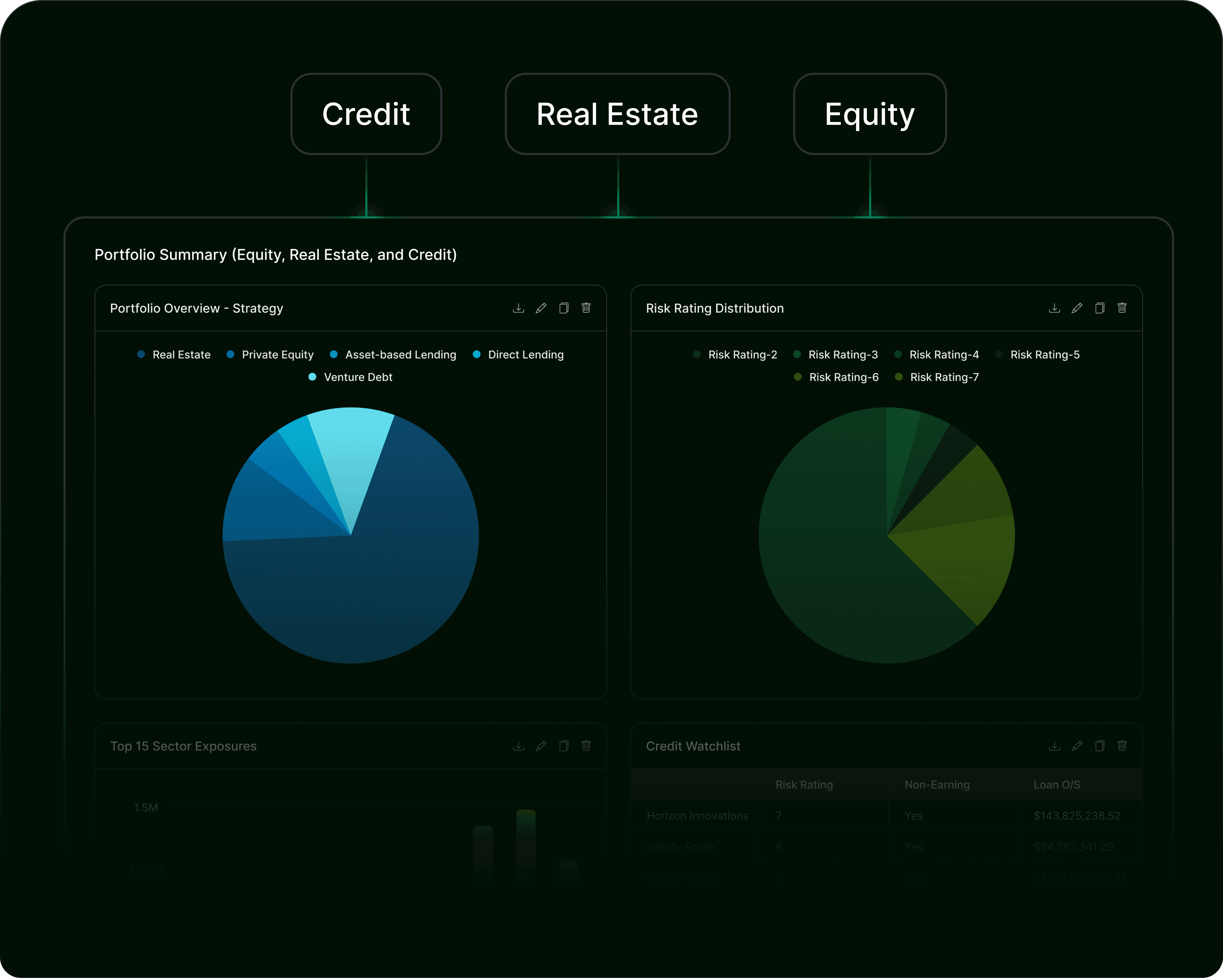

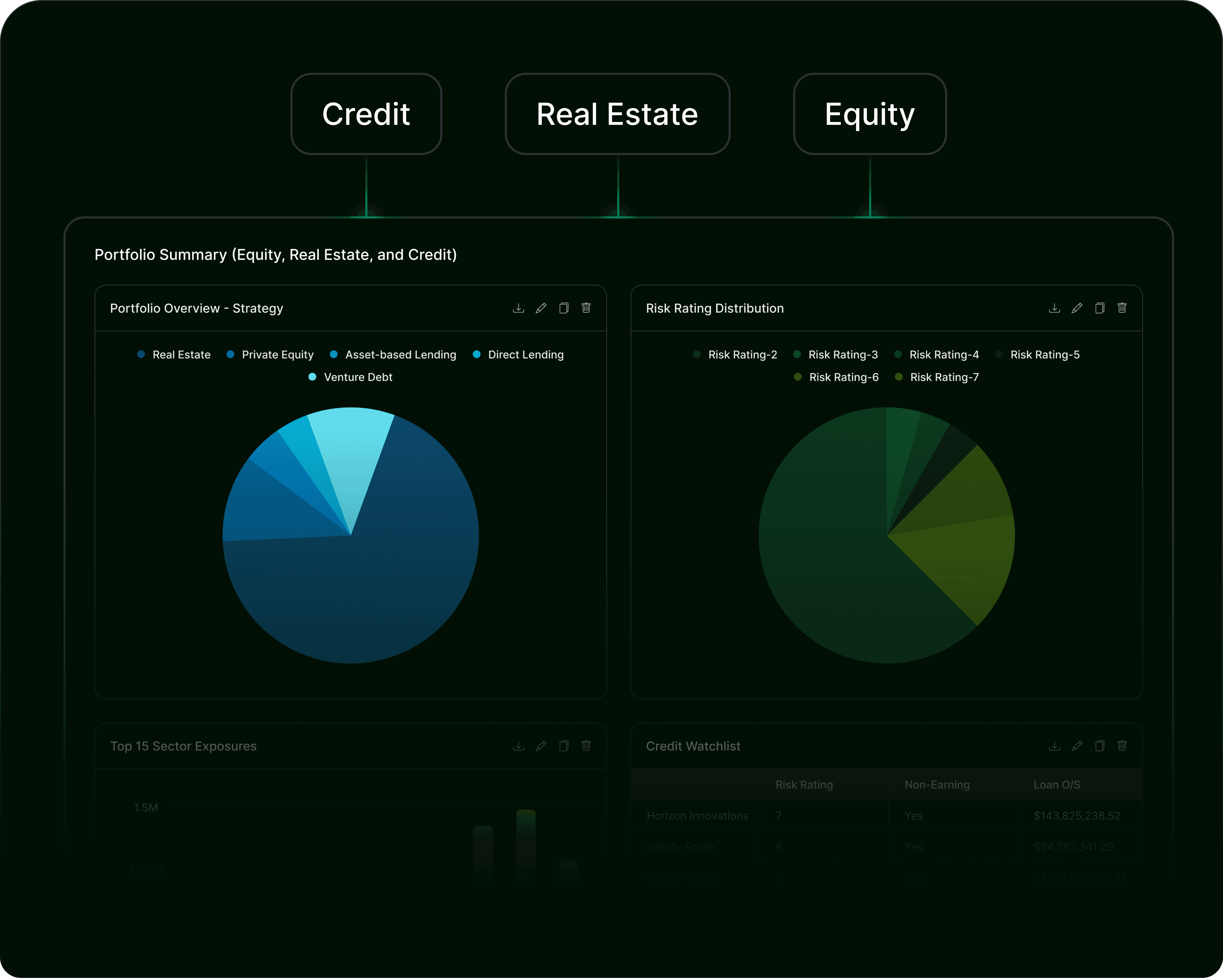

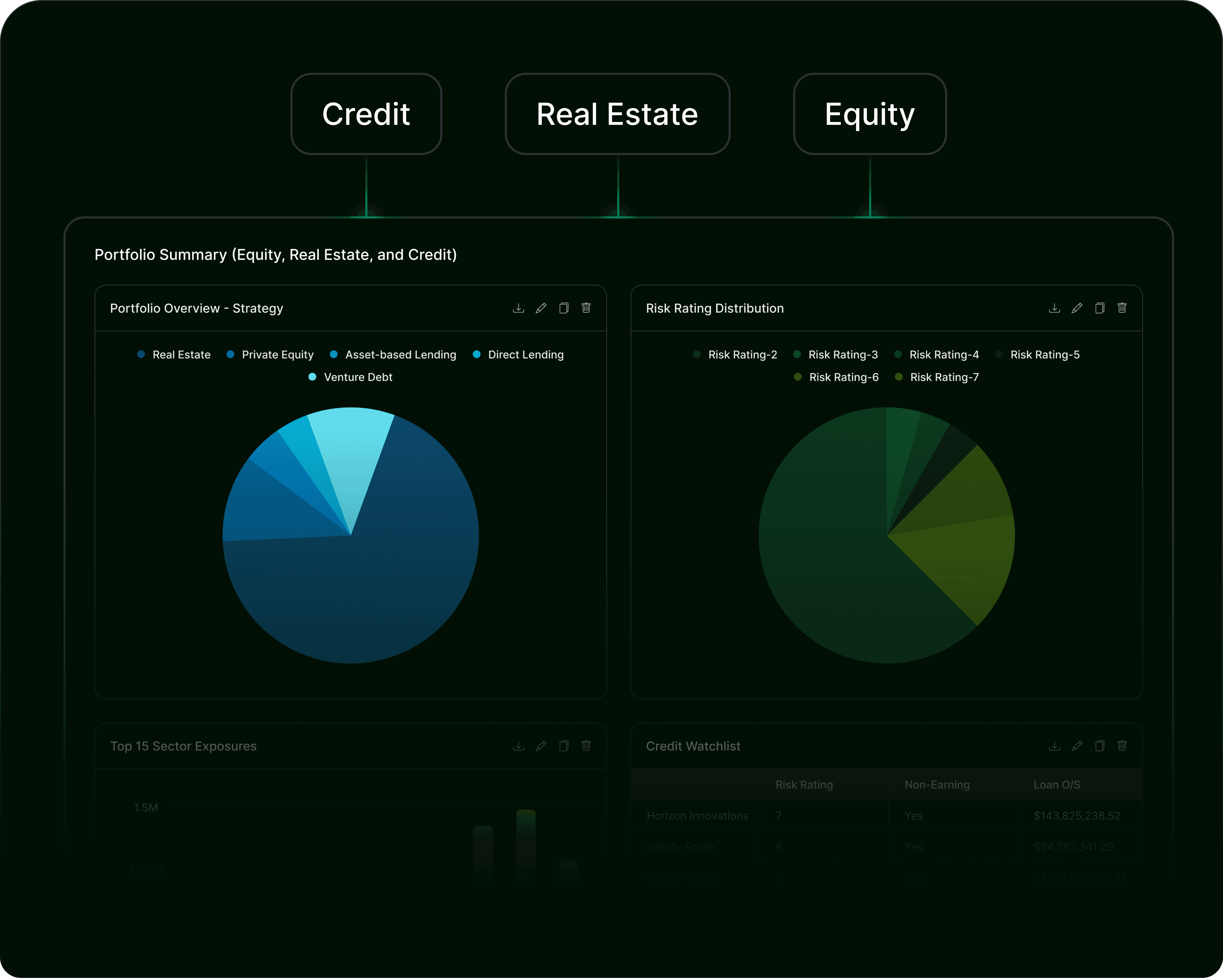

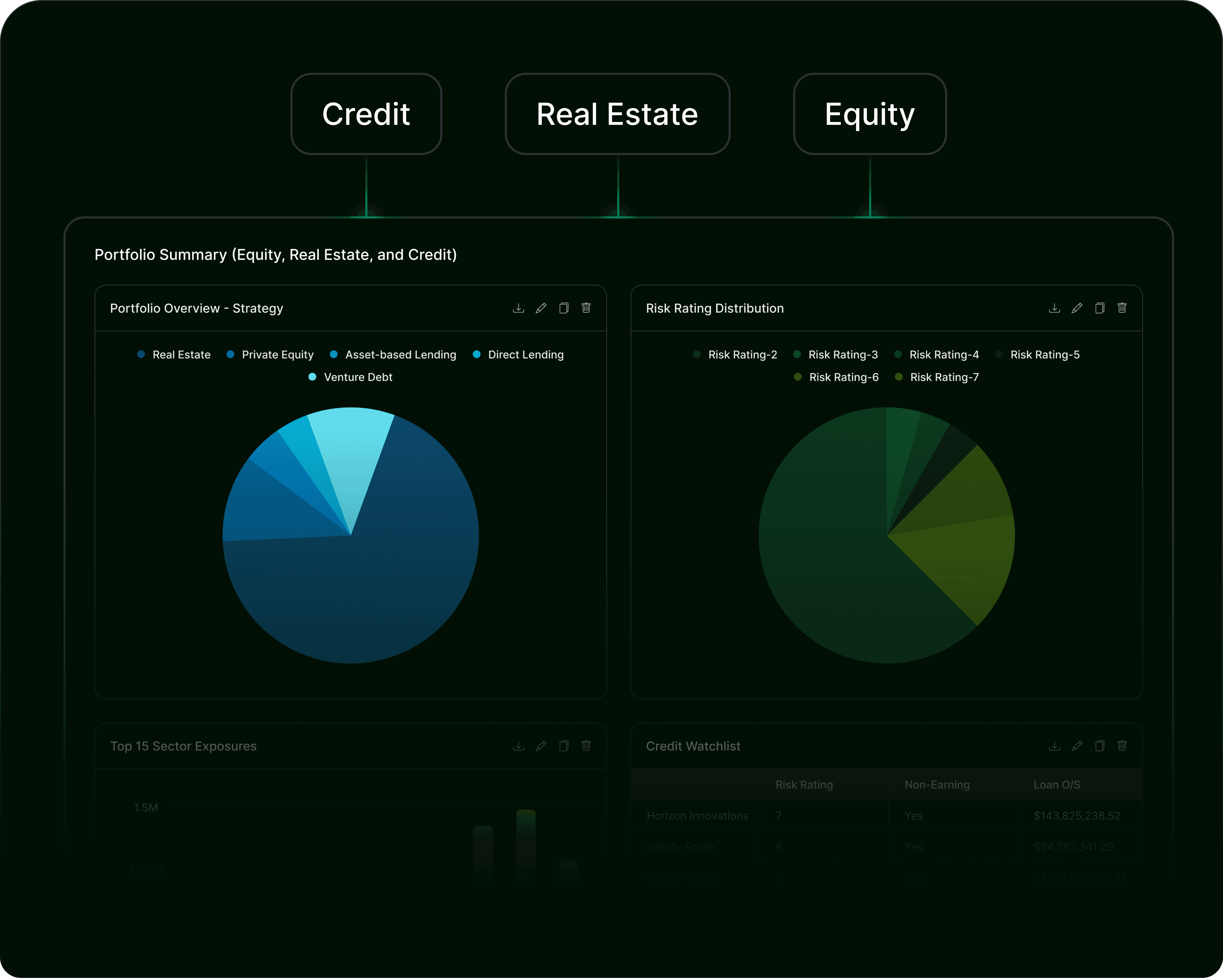

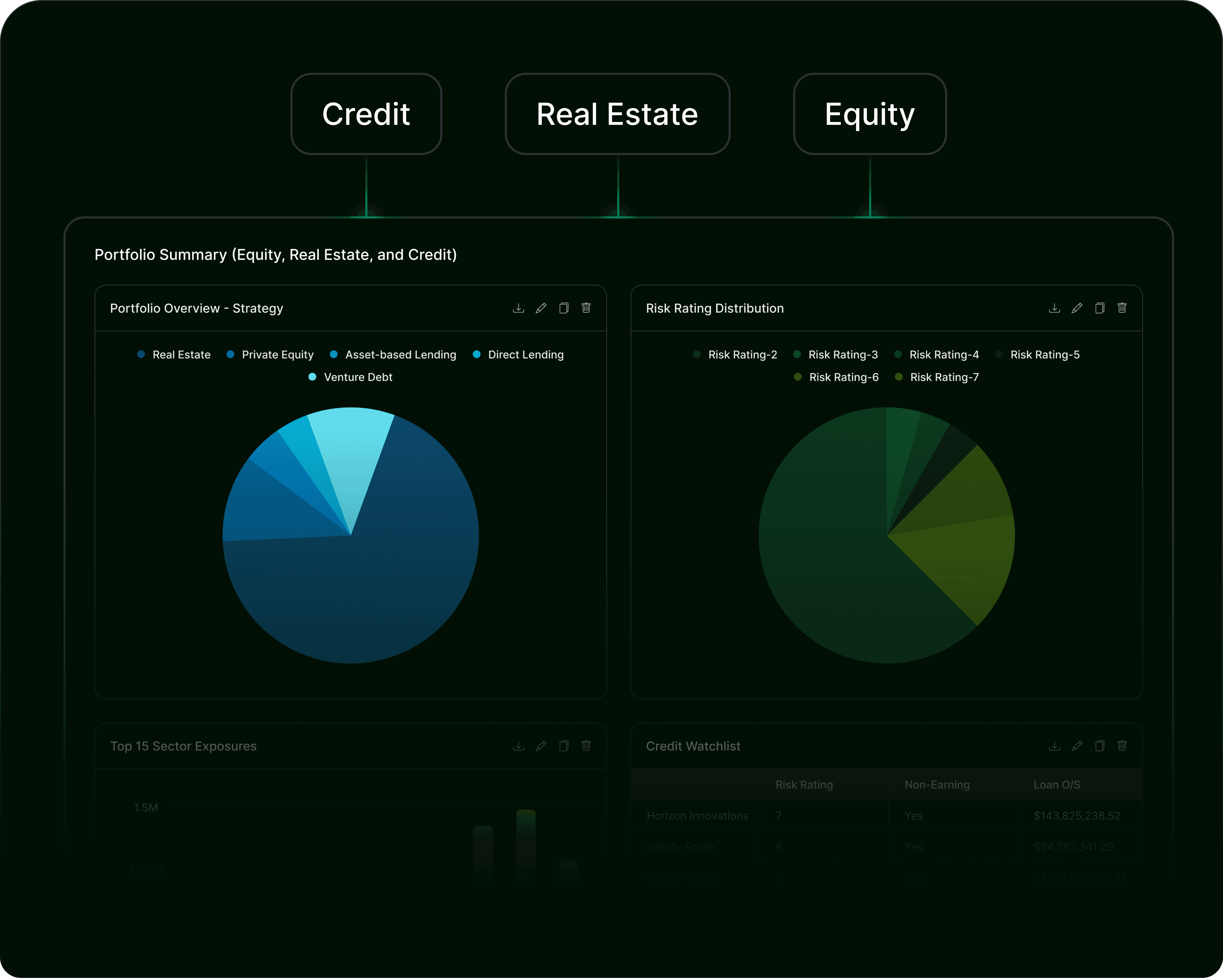

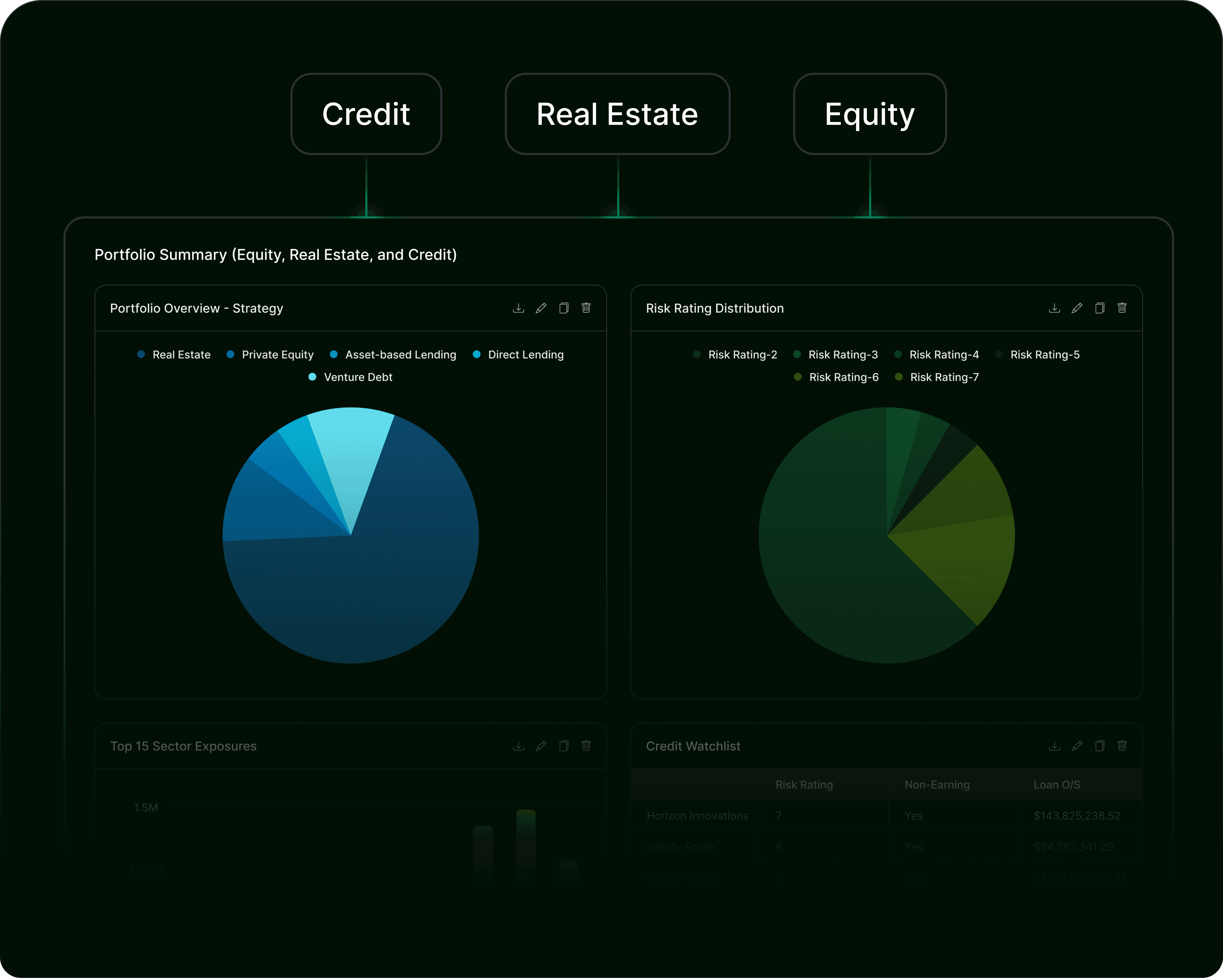

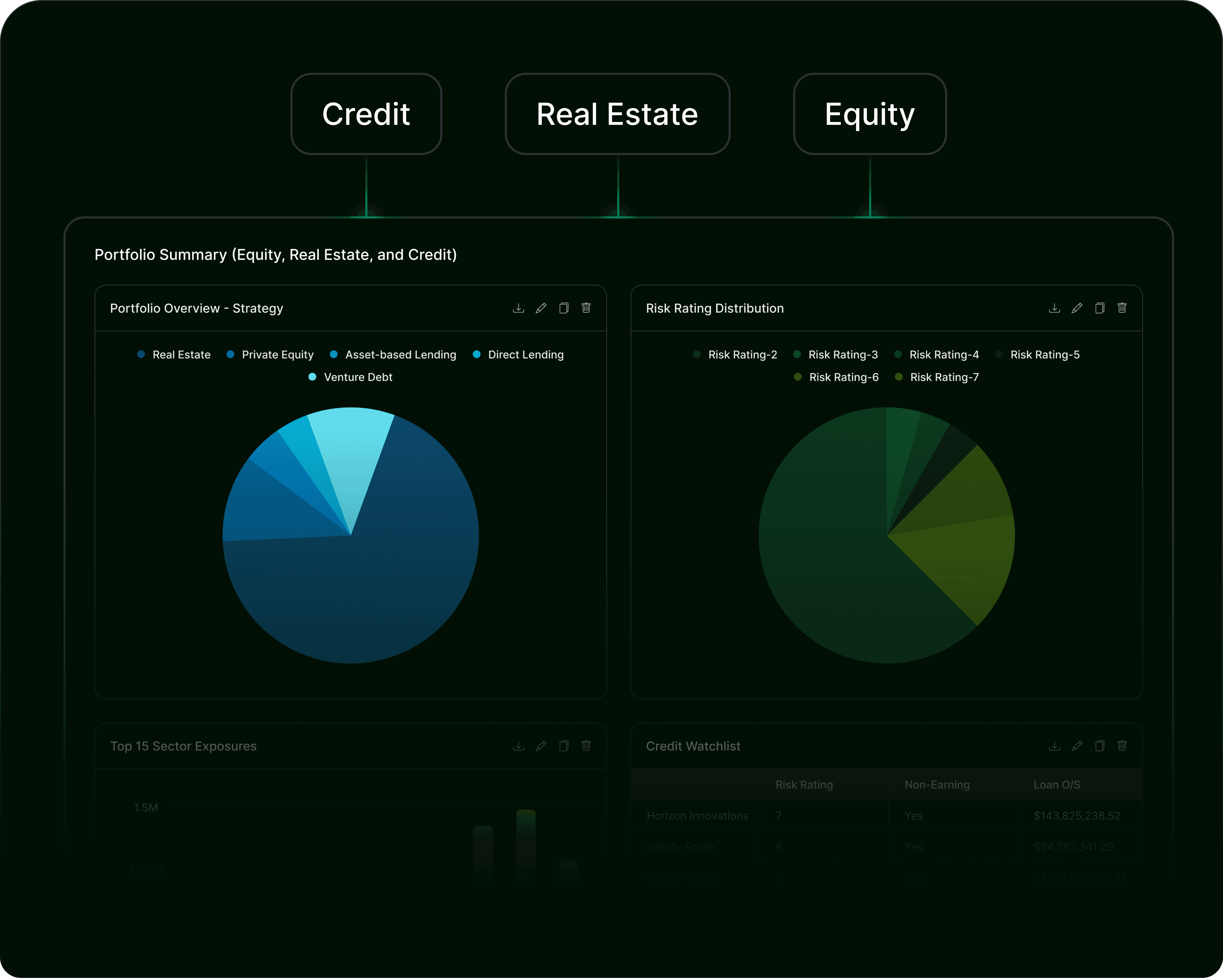

Bridging the gap between credit and equity

As your portfolio grows, your investment strategy evolves—integrating credit and equity. With our strong credit foundation, we natively support asset classes from real estate to private equity, powering funds of all sizes—from emerging managers to full-scale institutional asset managers.

Bridging the gap between credit and equity

As your portfolio grows, your investment strategy evolves—integrating credit and equity. With our strong credit foundation, we natively support asset classes from real estate to private equity, powering funds of all sizes—from emerging managers to full-scale institutional asset managers.

Bridging the gap between credit and equity

As your portfolio grows, your investment strategy evolves—integrating credit and equity. With our strong credit foundation, we natively support asset classes from real estate to private equity, powering funds of all sizes—from emerging managers to full-scale institutional asset managers.

Institutional-scale portfolio management, built for credit and equity

Institutional-scale portfolio management, built for credit and equity

Focus your team on investing, not data collection

Stop wrangling spreadsheets and chasing portfolio companies for data. Delegate data collection, ingestion, and portfolio review templates to us.

Focus your team on investing, not data collection

Stop wrangling spreadsheets and chasing portfolio companies for data. Delegate data collection, ingestion, and portfolio review templates to us.

Meet Lu, your AI-powered data wrangler

Access your data using natural language—empower anyone at your firm to ask questions and get instant answers. Accurate, real-time trends and easy drill-downs with complete data privacy.

Meet Lu, your AI-powered data wrangler

Access your data using natural language—empower anyone at your firm to ask questions and get instant answers. Accurate, real-time trends and easy drill-downs with complete data privacy.

Turn unstructured data into deal decisions

Unlock data trapped in spreadsheets—from underwriting models to monitoring reports. Build the proprietary benchmarking dataset you’ve always wanted and apply it to assess new and follow-on investments.

Turn unstructured data into deal decisions

Unlock data trapped in spreadsheets—from underwriting models to monitoring reports. Build the proprietary benchmarking dataset you’ve always wanted and apply it to assess new and follow-on investments.

Trust but audit your data

Harness the power of public market standards by accessing source data with full traceability to original files and underlying calculations. Always be one click away from source data—and monitor changes in actuals, budgets, and forecasts.

Trust but audit your data

Harness the power of public market standards by accessing source data with full traceability to original files and underlying calculations. Always be one click away from source data—and monitor changes in actuals, budgets, and forecasts.

Bridging the gap between credit and equity

As your portfolio grows, your investment strategy evolves—integrating credit and equity. With our strong credit foundation, we natively support asset classes from real estate to private equity, powering funds of all sizes—from emerging managers to full-scale institutional asset managers.

Bridging the gap between credit and equity

As your portfolio grows, your investment strategy evolves—integrating credit and equity. With our strong credit foundation, we natively support asset classes from real estate to private equity, powering funds of all sizes—from emerging managers to full-scale institutional asset managers.

Institutional-scale portfolio management, built for credit and equity

Institutional-scale portfolio management, built for credit and equity

Focus your team on investing, not data collection

Stop wrangling spreadsheets and chasing portfolio companies for data. Delegate data collection, ingestion, and portfolio review templates to us.

Focus your team on investing, not data collection

Stop wrangling spreadsheets and chasing portfolio companies for data. Delegate data collection, ingestion, and portfolio review templates to us.

Meet Lu, your AI-powered data wrangler

Access your data using natural language—empower anyone at your firm to ask questions and get instant answers. Accurate, real-time trends and easy drill-downs with complete data privacy.

Meet Lu, your AI-powered data wrangler

Access your data using natural language—empower anyone at your firm to ask questions and get instant answers. Accurate, real-time trends and easy drill-downs with complete data privacy.

Turn unstructured data into deal decisions

Unlock data trapped in spreadsheets—from underwriting models to monitoring reports. Build the proprietary benchmarking dataset you’ve always wanted and apply it to assess new and follow-on investments.

Turn unstructured data into deal decisions

Unlock data trapped in spreadsheets—from underwriting models to monitoring reports. Build the proprietary benchmarking dataset you’ve always wanted and apply it to assess new and follow-on investments.

Trust but audit your data

Harness the power of public market standards by accessing source data with full traceability to original files and underlying calculations. Always be one click away from source data—and monitor changes in actuals, budgets, and forecasts.

Trust but audit your data

Harness the power of public market standards by accessing source data with full traceability to original files and underlying calculations. Always be one click away from source data—and monitor changes in actuals, budgets, and forecasts.

Bridging the gap between credit and equity

As your portfolio grows, your investment strategy evolves—integrating credit and equity. With our strong credit foundation, we natively support asset classes from real estate to private equity, powering funds of all sizes—from emerging managers to full-scale institutional asset managers.

Bridging the gap between credit and equity

As your portfolio grows, your investment strategy evolves—integrating credit and equity. With our strong credit foundation, we natively support asset classes from real estate to private equity, powering funds of all sizes—from emerging managers to full-scale institutional asset managers.

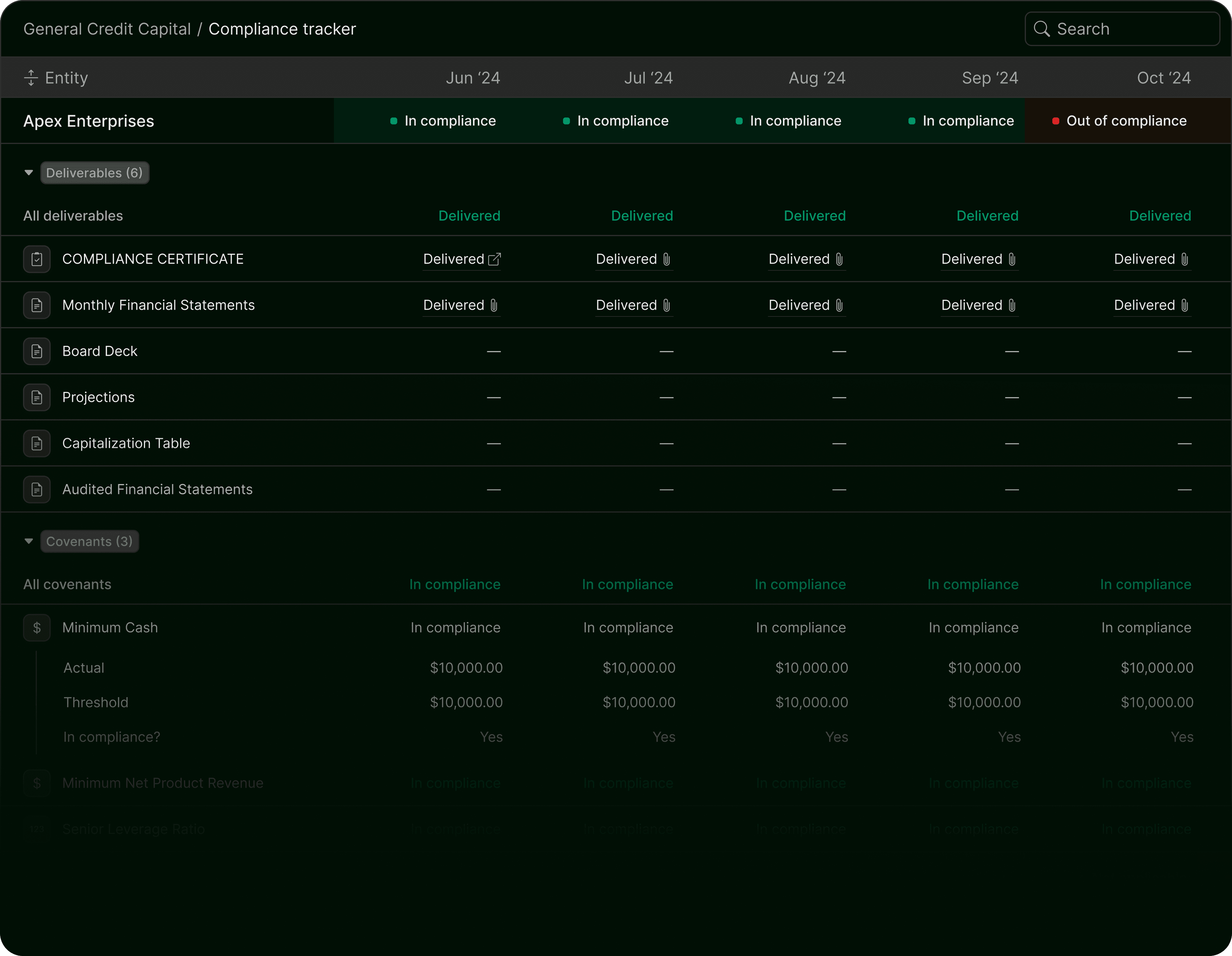

Deposit Account Control Agreements

Deposit Account Control Agreements

Borrowing base certificates

Borrowing base certificates

Perfection certificates

Perfection certificates

Compliance certificates

Compliance certificates

Financial Statements

Financial Statements

Reporting covenants

Reporting covenants

Financial covenants

Financial covenants

Credit agreements

Credit agreements

Stop chasing down reporting packages

Stop chasing down reporting packages

Get Lumonic to do it for you

Talk with us

Talk with us

© 2026 Lumonic Inc., a PitchBook company.

© 2026 Lumonic Inc., a PitchBook company.

© 2026 Lumonic Inc., a PitchBook company.

Asset Class

Resources

© 2026 Lumonic Inc., a PitchBook company.